Banking Crisis 2023: Your Questions Answered

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

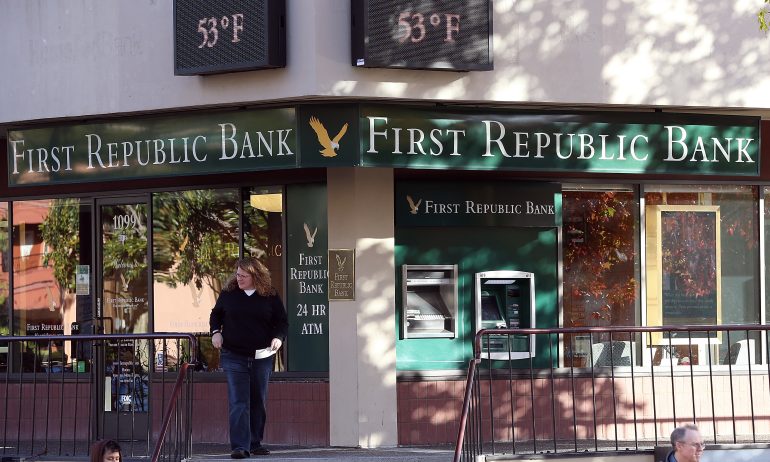

Update as of May 4: There’s already trouble brewing for another bank: PacWest Bancorp, a midsize regional lender based in Los Angeles. On Wednesday, Bloomberg News first reported that PacWest Bancorp was in the midst of a selloff, mere hours after Federal Reserve Chair Jerome Powell said that the banking system is “sound and resilient.” Following reports of a selloff, the share price of PacWest Bancorp fell suddenly by more than 50%.

PacWest said, in a statement Thursday, that it was already planning to sell its $2.7 billion loan portfolio and is now evaluating potential partners and investors. The statement also said, “The bank has not experienced out-of-the-ordinary deposit flows following the sale of First Republic Bank and other news.”

An updated version of the original story below published March 31.

Recent banking failures in the U.S. and Europe have prompted government interventions in an effort to contain the crisis. The collapses have brought discussion about regulating the banking sector back into the spotlight in a way we haven’t seen since the Great Recession. The phrase “too big to fail” has made its way into the zeitgeist once again.

On March 21, U.S. Treasury Secretary Janet Yellen said in a statement to the American Bankers Association, “The situation is stabilizing. And the U.S. banking system remains sound.”

Some economic wonks and lawmakers are now arguing for reform including an increase to the $250,000 Federal Deposit Insurance Corp. insurance cap. And midsize banks are asking the FDIC to insure all deposits for at least two years, according to reports. But House Republicans are calling for an end to banking bailouts and said they oppose “any universal guarantee on bank deposits over the current limit.”

However, on March 22, Yellen told senators, “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.”

Meanwhile, the Federal Reserve isn’t backing down from its mission to tame inflation. The Fed opted to raise the federal funds rates by 25 basis points on May 3. It’s the 10th increase the Fed has called for since March 2022. Last year, the Fed raised interest rates by 75 basis points four times in a row. The latest hike brings the current rate level to 5.00%-5.25%.

To get you up to speed on the 2023 banking crisis, here are answers to popular questions about recent events.

- Bluevine Business Checking

- What is a budget?

- Life insurance buying guide

- Definition of a stock

- What is the capital gains tax?

- Definitions: Money Transfer Rates

- Current promotional CD rates

- How do CDs work?

- Checking account vs. savings account

- How to earn a Chase checking account bonus or savings account bonus

- Fund definition

- What is mortgage pre-qualification?

- What is a charitable donation?

- What is a budget planner?

- Best banks for multiple savings accounts

- What is cryptocurrency?

- What is IRMAA?

- Dollar-cost averaging definition

- See how to get your business started quickly

- Quickbooks Online

- What is a bond?

- What is IRS Form SS-4?

- What is an estate tax?

- Online sales and auctions

- What is a backdoor Roth IRA?

- What is Form W-9 for?

- » This page is out of date

- When is the best time to pay your credit card bill?

- What is a cashier's check?

- What is SBA Form 413?

- What are I bonds?

- What is online banking?

- What are the Roth IRA rules?

- Roth IRA meaning

- What is a W-2 form?

- Medicare Advantage companies

- What is a Treasury bond?

- Our Take

- What is a Treasury bill?

- What is a nonsufficient funds, or NSF, fee?

- What is a rollover IRA?

- What is the FIRE movement?

- High-dividend ETFs may generate income

- What is a safe deposit box?

- The parts of Medicare

- What is the mortgage interest deduction?

- Net worth defined

- What is a FICO score?

- Shopify Ecommerce

- Fidelity is best for:

- Vanguard is best for:

- Blockchain: A definition

- Find the right Medicare Part D prescription drug plan

- What is a life insurance beneficiary?

- What is passive investing?

- What is an inheritance tax?

- What is a custodial Roth IRA?

- What are stocks?

- What is an FHA loan?

- Key takeaways

- Update:

- » This story is out of date

- » This story is out of date:

- What's an investment strategy?

- ZenBusiness: Fast & Simple LLC Formation

- Novo Business Checking

- About this tool

- What is ESG?

- Mortgage rates today: Wednesday, May 24, 2023

- What is personal finance?

- ZenBusiness: Start Your Dream Business

- Investing definition

- What is Upwork?

- What is a home equity line of credit?

- What is a 401(k) plan and how does it work?

- E*TRADE is best for:

- Robinhood is best for:

- What factors determine mortgage rates?

- What is the qualified business income deduction?

- What is the average stock market return?

- Question:

- Why is retirement planning important?

- State Farm business insurance

- » This offer has expired

- Operating revenue definition

- Premarket trading definition

- What is an inherited IRA?

- Long-term investments definition

- Top stock gainers today

- May mortgage outlook

- What is a meme stock?

- What Medicare covers

- Find the right Medicare Supplement Insurance plan

- What is an IRS audit?

- Hyperinflation definition

- Can you pay the mortgage with a credit card?

- QuickBooks Payroll

- ZenBusiness: Fast & Simple S-Corp Formation

- What are closing costs?

- What is IRS Form 1040?

- » This article is out of date.

- » This page may be out of date

- What is an authorized user?

- Compare types of bank accounts

- Broker definition

- What is adjusted gross income (AGI)?

- What are LLC articles of organization?

- Acorns is best for:

- What the Federal Reserve did and why

- What is a certified financial planner (CFP)?

- What is a debit card?

- To make money in stocks, stay invested

- Mortgage rates today: Thursday, May 25, 2023

- What is a personal loan?

- What is a special needs trust?

- Looking for more money?

- » This card is not accepting applications

- » This review is out of date

- IRA vs. 401(k): The quick answer

- What is a SEP IRA?

- What is a tax dependent?

- What is a donor-advised fund?

- Definition of mortgage refinance

- 401(k) withdrawal calculator

- What is wealth management?

- » This offer has expired.

- What is a secured credit card?

- What is a hedge fund?

- What is an ESPP?

- Find the right Medicare Advantage plan

- » These offers have expired

- » This card is no longer available

- What is the earned income tax credit?

- What are options?

- Sage50

- What is a Coverdell ESA?

- When are taxes due in 2023?

- Mortgage rates today: Friday, May 26, 2023

- Charles Schwab is best for:

- 5 Best Ways to Send Money Internationally

- Missing a payment

- 1. Excessive fees

- Alternatives to waiting on hold

- Should you bother with airline rewards?

- 3 times credit card perks make it better

- How to appeal a credit cut

- Maxing out your credit limit

- Wait times vary

- Why your credit scores might drop

- 2. Exorbitant interest rates

- Spending more than you can afford to pay back

- How to safeguard your credit

- 3. Low credit limits

- When it might not matter

- Closing a card account without a strategy

- What’s in it for you?

- Take reasonable precautions

- Why an issuer might reduce your credit limit

- Paying your credit card statements without looking

- 4. Partial credit reporting

- How to minimize the chance of a cut

- 5. No upgrade path

- Optional: Get an airline credit card?

- Optimize your miles

- Expert level: Earn elite status

- Additional resources

- What is AutoSlash?

- How much should you spend on rent? Try the 30% rule

- 1. Get creative

- Free financial advice

- What is an amended tax return?

- Active vs. passive investing

- Navigating salary ranges

- How do capital gains taxes work on real estate?

- What is the gift tax?

- What is a tax ID number (TIN)?

- Best lithium stocks

- What is a utility bill?

- Advisor or adviser?

- 1. Mortgage interest

- Small-cap ETF definition

- Best tax software providers

- What is the Schedule A?

- How much is an oil change?

- ETF vs. mutual fund

- What is a REIT?

- Forex trading definition

- I don’t have extra cash to put toward my credit card debt. What are my options?

- What is a 529 account?

- 1. Hit the minimum spending requirement

- Virginia Housing highlights and eligibility requirements

- SIMPLE IRA contribution limits

- What’s the difference between cashier’s checks and money orders?

- First, what type of financial help are you looking for?

- Easiest ways to earn Marriott Bonvoy points

- Low annual fee

- 1. Go to a museum, aquarium or zoo

- Super Bowl season

- What is an emergency fund?

- What is a fiduciary?

- Bond ETF definition

- What is FICA tax?

- What does it mean to pay yourself first?

- What is a PLLC?

- 1. Changi Airport Singapore

- What is self-employment tax?

- Bookkeeper vs. accountant comparison

- 1. Inflation has slowed for 10 months straight

- Key takeaways:

- Credit unions vs. banks

- 1. Google

- What is a construction loan?

- Overview

- Investing 101: A summary of the basics

- What is FedNow?

- Calculate your wedding budget

- How to make money as a kid

- 25 reasons your car insurance is so expensive

- What is a home inspection?

- How to use a savings goal calculator

- What type of income is not taxable?

- What is a tax credit?

- What is a wash sale?

- What is tax evasion?

- What's the average Roth IRA interest rate?

- Calculate your conventional loan payment

- The stock market explained

- What are oil ETFs?

- Cash advances

- Determining how much mortgage I can afford

- 2022 Arizona state income tax rates and tax brackets

- Teacher Next Door program

- What are the best months to buy appliances?

- Myth 1. Leaving a balance on your credit card is good for your score

- What are brokerage fees?

- What is Medicare?

- The best way to invest money: A step-by-step guide

- Do you pay capital gains tax on stocks?

- What is a good used iPhone model?

- What is an IRS 1099 form?

- 1. Sign-up bonus

- What is a 401(k) rollover?

- Why you might like the Apple savings account

- 4 ways to cash a check without a bank account

- When curbside check-in makes sense

- What is an accredited investor?

- What are bonds and how do they work?

- 1. Your information

- Hawaiian Airlines checked bag fees

- Tax benefits of buying a home

- T-Mobile cell phone plans

- What is a target-date fund?

- What you need to know

- Why now is the best time to renew your passport

- Types of mutual funds

- What is a state income tax?

- 1. Minimum amount to open

- What makes a good business idea for teens?

- What is a routing number?

- Mutual funds definition

- Best for:

- VA loan eligibility

- Best-performing large-cap ETFs

- Word of mouth

- Key takeaways

- 7 budgeting tips for everyone

- Free checked bags

- NAV meaning and why it matters

- What is equity crowdfunding and how does it work?

- Savings accounts

- What to expect flying premium economy with Singapore Airlines

- 1. Living expenses if your home is damaged

- 5 ways to save money flying United Airlines

- Roth vs. traditional: How to choose

- What is financial planning?

- Fee-only vs. fee-based

- What the law says

- What is a hot market in real estate?

- What is a VA loan?

- Impact investing definition

- Earn your miles

- Investment calculator

- Chase Sapphire Preferred® Card vs. Discover it® Miles: Rewards

- Best-performing real estate ETFs

- Switch or stay?

- Know your state’s rules

- Robo-advisor definition

- 1. Your credit score

- What is married filing separately?

- What is a money market account?

- 1. What is Marriott’s M Club lounge?

- How to get your free credit report information

- 1. Determine how much to save for a down payment

- Attractive welcome bonus

- What is Venmo?

- It's totally doable

- Make sure your idea can be profitable

- What is a Roth 401(k)?

- Roth IRA taxes

- Snapshot comparison

- Money market account vs. CD: The difference

- Are game show winnings and prizes taxable?

- What is an IRS IP PIN and what does it do?

- What is Medicare assignment?

- 401(k) withdrawal rules

- What are biotech stocks?

- What is an index fund?

- How money market funds work

- What is a home appraisal?

- Open another account first

- What to expect flying international economy with Qantas

- What Is a SIMPLE IRA?

- How much is the annual fee?

- What is an expense ratio?

- IHDA highlights and eligibility requirements

- What is value-added tax (VAT)?

- Best-performing gold ETFs

- Should you withdraw your retirement funds early?

- How it works

- Best-performing tech ETFs

- Bullish vs. bearish: What’s the difference?

- What is Rule 144?

- High-value hotels in Vancouver to book with points

- What is the Bags on Time guarantee?

- How much is a 30-year-mortgage payment?

- What are the benefits of an LLC in NY?

- Option 1: Use your tablet as a phone over Wi-Fi

- Benefits

- Early retirement health insurance options

- Capitalize on off-hours

- You're receiving two separate payments

- Growth vs. value: What's the difference?

- Who must comply

- Work from home jobs often pay more

- What is Prime Day?

- What is a credit card CVV?

- What is stock trading?

- 1. Install a plug-in towel warmer

- Does homeowners insurance cover plumbing problems?

- The benefits

- How travel credit cards generally work

- How to invest in oil

- How long does it take to clear a check?

- How to redeem Capital One miles for statement credit

- Investing for kids

- What is a savings account?

- What does tax exempt mean?

- What is a tax levy?

- What is a solo 401(k) plan?

- What is a family budget?

- What companies are included in the S&P 500?

- 1. You can go back only 3 years

- 1. Standard CD: The regular box

- What is Regulation E?

- Freelancing

- Understanding your home improvement loan calculator results

- Traditional IRA early withdrawal rules

- How much down payment is needed for a business loan?

- Fifth Third Bank business checking is best for small-business owners who:

- What is a first-time home buyer grant?

- 401(k) contribution limits in 2022

- Lyft driver requirements

- How long does it take to recoup refinance costs?

- Earn money while you spend money

- 1. Don't keep spending as usual

- Stack credit card offers for big savings

- 2. Avoid relying on your credit limit

- 3. Don't carry a balance on a high-interest credit card

- Inflation-era travel on a budget

- 4. Stop racking up late fees

- 5. Think twice about cash advances

- What is a HELOC?

- How commercial construction loans work

- One question to ask yourself: What type of help are you looking for?

- All about the Schumer box

- 7 of the best apps to make money

- How to get paid on YouTube

- How much do solar panels cost for homes?

- What are dividend stocks?

- Where to exchange currency in the U.S. before your trip

- About the federal Pell Grant

- Microsoft Office Excel budget templates

- Where to buy bonds

- Airlines in the Star Alliance

- What are short-term investments?

- Run them through your estate plan

- 1. The home office deduction

- Wanna Get Away Plus features

- Are charitable donations tax deductible?

- If you have great credit

- Is 100 points realistic?

- What is the standard deduction?

- 4 budgeting methods to consider

- Loss or damage already covered by your own auto insurance

- How is the Medicare IRMAA calculated?

- How to start a vending machine business in 6 steps

- 1. Reward social media sharing

- What is a conventional mortgage?

- How does mortgage protection insurance work?

- What is a down payment?

- What is day trading?

- 1. Decide on a business location type

- The 5 best business plan software options

- What should I know when choosing CDs?

- The best budget apps

- Is standard repayment right for you?

- How tax returns factor into business loan applications

- Why your credit score matters to lenders

- 1. Join store loyalty programs

- Tax filing status options

- The definition of a recession

- What does this value mean?

- Rack up bonus points

- What are the airline’s baggage fees?

- What to know before getting The Platinum Card® from American Express

- How long does it take to get a new credit card?

- What is the SENTRI Pass?

- How to contact IRS customer service

- 1. The best credit cards aren’t for beginners

- Earn points by charging purchases

- Step 1: Choose your health insurance marketplace

- How do I buy a prepaid debit card?

- Credit card basics

- How to start a meal prep company in 7 simple steps

- 1. Sign up for deal alerts

- How to get TSA PreCheck for free

- What is a 1099-INT tax form?

- Supreme Court deciding student debt cancellation fate

- If you pay in full every month: APR doesn't matter

- What is net worth?

- Best Prepaid Debit Cards

- Why landlords typically require a credit check to rent an apartment

- What you need to open a bank account

- Exchange gift cards for ones you actually want

- Mortgage options

- 1. Purchase discounted Disneyland tickets

- Capital One Venture X Rewards Credit Card vs. Chase Sapphire Reserve® benefits

- What is the child tax credit?

- Where they’re based and where they fly

- Pros & Cons

- 1. The beer enthusiast

- Delta Air Lines refund policy

- How much does a wire transfer cost?

- The biggest U.S. frequent flyer programs

- What is options trading?

- Why are debt validation and debt verification letters important?

- 6 key takeaways on the racial funding gap

- Assess your debt load

- First, some background and a caveat

- Step 1: Choose a name and business entity

- What is my net worth?

- What is AmEx’s once-per-lifetime rule?

- 1. Find a payment strategy or two

- 6 things to know about United's delayed flight compensation

- The basic differences

- The similarities between Hyatt Place and Hyatt House

- Best time to buy furniture

- How to calculate your credit utilization ratio

- 10 ways to fly American cheaper

- What kinds of coupons does Etsy have?

- What is a high-deductible health plan?

- To get a wheelchair, you must satisfy several conditions

- What does APY mean?

- Key findings

- What are Vanguard index funds?

- How to start a car wash business

- How much does a wedding cost?

- What to know if you have a charge-off

- Is 4% a high rate?

- Snapshot comparison

- Savings calculator tip

- How much can you contribute to a 401(k)?

- Fixed rates vs. variable rates

- COVID-19 Economic Injury Disaster Loans

- 1. Certificates of deposit (CDs)

- 1. Non-retirement goals

- 1. Identify your client

- Do I qualify as a first-time home buyer?

- Holding Bitcoin

- What are HSAs and FSAs?

- 1. Create a business plan

- Where can I get IRS tax forms?

- How much to save in your emergency fund

- Getting to Washington, D.C.

- Do I need credit insurance?

- What to know about National Emerald Club

- 1. Complete tasks with Amazon’s Mechanical Turk

- What is a goodwill letter?

- Using equity to remodel

- What is United TravelBank? How does it work?

- 1. Compare sites and deals

- What is an LLLP?

- When to choose a Hilton credit card

- When to visit Honolulu

- 6 ways to get cheap internet

- Transfer your points to airline partners

- 5 reasons to love the Aeroplan loyalty program

- 1. Define your line

- What is LTV?

- American Airlines flight change policy

- How much should I save?

- How do you find your old 401(k)?

- What to look for in a health insurance plan

- Financial coach definition

- What is a brokered CD?

- Citibank interest rates, fees

- Which cards can Puerto Rico residents get?

- Crater Lake National Park

- Stop payment fees by financial institution

- Decide your budget for total employee salaries

- Credit score mortgage calculator FAQ

- 1. Accounting Coach

- Why is personal finance important?

- Pivot to a positive mindset

- The differences between economy and first class

- The major differences

- How it works

- How JetBlue TrueBlue points work

- Can business owners file for unemployment?

- 1. Not figuring out how much house you can afford

- How to find a million-dollar business idea

- Investing vs. saving

- Advantages of franchising for the franchisee

- What is a portfolio?

- The Aeroplan® Credit Card annual fee is worth it if you …

- Disneyland vs. Disney World size

- How to get Aeroplan points

- Know what makes a good score

- Small business new year’s resolutions for 2022

- You could earn more with a master’s degree

- Determining needs

- Mortgage rate factors that you control

- What is Amazon Prime?

- Why is inflation so high?

- What are TIPS?

- How to start a laundry business in 10 steps

- How to open a gas station

- Answer:

- Shared services at the Disney Swan and Dolphin

- How does a credit-builder loan work?

- Service business ideas: The top 15

- 1. Figure out what living debt-free means to you

- 1. Know your enemy

- Choose a business name and structure

- What is a health savings account (HSA)?

- What is short selling?

- What is a cash offer on a house?

- What are clean energy ETFs?

- Credit card consumer protections improved

- Should I put non-debt bills on a credit card?

- 1. The Platinum Card® from American Express

- What's the difference between a 15-year and 30-year mortgage?

- Who takes out payday loans?

- How to maximize your Marriott Bonvoy Brilliant® American Express® Card

- What are some e-commerce business models?

- 1. Joining Marriott Bonvoy is free

- Clunky seats limit legroom, but double armrests offer comfort

- Questions to ask before hiring your first employee

- Why are there two versions of Bitcoin?

- Moped, motor scooter or motorcycle?

- April 29 - United Debuts New, and Faster, Ways to Earn Status

- Home business ideas

- How therapy can increase income

- Local alternatives to payday loans

- 5 ways to save money when you fly Southwest Airlines

- Match asset location and investment choice

- Generally, closing a bank account doesn't affect your credit

- 13 ways to get the best online deals

- How meme stocks work

- 1. Make extra payments toward the principal

- Social Security vs. Medicare

- Grace periods are based on billing cycles

- Amazon credit card options

- How much are United miles worth?

- Overview of business loans

- What is Zelle?

- How much is a speeding ticket in California?

- Hyperinflation causes

- 1. There are 3 Harley cards

- 1. No blackout dates

- The main differences between Delta Comfort Plus vs. first class

- January

- 1. Create an Etsy account

- Preparing to buy tips

- Payroll basics

- 39 green business ideas

- The main differences

- What's the best S&P 500 ETF?

- 1. ShopSavvy - Barcode Scanner

- Summary of Visa Signature benefits

- Are student loans counted in your debt-to-income ratio?

- Shopping for a personal loan

- Food and drink

- 1. Check what you already have and make a list

- Where in Mexico can I visit with Southwest?

- What is sustainable banking?

- American Express cards that give airport lounge access

- 1. Shop with purpose

- Mobile, manufactured and modular homes: What's the difference?

- Frontier refund policy

- Capital One 360 savings rate, fees

- Types of savings accounts

- What is the average cost of groceries per month?

- Spirit Airlines award sweet spots

- U.S. passport photo requirements

- 1. 'Stack' store and manufacturer's coupons

- What to know before getting the Aeroplan® Credit Card

- What is VantageScore 4.0?

- Calculate your points' value

- Average retirement savings by age

- Why you don’t have a credit score

- What is innocent spouse relief?

- How to contact JetBlue customer service

- What is a DUNS number?

- Financial advisor fees

- Consumer credit cards

- Who buys a house with cash?

- Understanding car values

- What's the best way to invest $10,000?

- Why get an airline credit card

- What the Fed did and why

- Make sure the car qualifies for road testing

- Are any stocks recession-proof?

- Know your goals

- Allow up to 50% of your income for needs

- Getting to Charlotte

- What co-signing really means

- About Qatar Airways

- Getting to Oakland

- Does the tax extension deadline apply to me?

- Ways to maximize the Wells Fargo Propel American Express® card

- Getting to San Diego

- Greenwashing definition

- Free stock screeners

- Get your welcome bonus for new cardholders

- How Frontier Airlines flight credits work

- Why Sapphire holders need the Chase Freedom Unlimited®

- How to use the auto lease buyout calculator

- Number of properties and pricing

- What are bank stocks?

- 1. Determine your state’s workers’ comp requirements

- How to get discounted or free phone service for low-income households

- 1. Decide which provider to use

- What should I put in my Roth IRA?

- When to open multiple brokerage accounts — and why

- 21 Small-business tax deductions

- Best Hilton Caribbean resorts

- What is an emergency loan?

- What is personal property insurance?

- Step 1: Price your trade-in

- What day is my June payment coming?

- National first-time home buyer programs

- Can you transfer American Airlines miles to Alaska?

- How much are pharmacists’ loan payments?

- 1. Sign a contract

- How do CDs work?

- What are derivatives?

- What is the SkyMiles Marketplace, and how does it work?

- What are the benefits of a donor-advised fund?

- Register your drone

- When there is no pet

- What is a growth stock?

- 1. Tax planning starts with understanding your tax bracket

- How life insurers view anxiety

- About Singapore Airlines

- What is content marketing?

- 1. Automate key business functions

- Making money with Rover

- What is covered by cleaning business insurance?

- Should you withdraw money from a 401(k) early?

- What does a wealth manager do?

- Step 1: Understanding the basics

- What is a financial planner?

- What is a credit card APR?

- Debt management

- You can temporarily self-report income

- What is a payday alternative loan?

- Industry-wide policies and important notes

- What is Autotrader?

- Rising debt and delinquencies

- 1. You’ve reached your credit limit

- What does beta mean in stocks?

- Best Priority Pass credit cards

- How a fixed-rate mortgage works

- Pre-work: Create a budget

- Lufthansa economy fares

- Top business ideas for nurse entrepreneurs

- What is identity theft insurance?

- What to expect flying economy with Singapore Airlines

- What is tax relief?

- What is direct deposit?

- Earn the 50,000 bonus miles

- How voluntary repossession works

- The best hotel loyalty programs for free stays via credit cards

- What happened to the FAA?

- How to get paid on TikTok

- Which state do you owe taxes to?

- What ANA miles are worth

- Buy: Patriotic items

- Litecoin wallets

- What does professional liability insurance cover?

- What is an interest-only mortgage?

- What is a cash-back app?

- IHG Executive Club Lounges

- What types of Hyatt free night awards are available?

- What is Disney Park Hopper?

- How do I get Southwest drink coupons?

- Overview of trademark registration

- Mortgage income calculator help

- LendingClub business checking is best for small-business owners who:

- Synthetic oil vs. conventional oil

- How do credit union loans work?

- 1. Decide where to buy Disney stock

- Double-decker airplane seat concepts

- Here’s how to deposit cash in an ATM

- What is a company overview?

- Investment account types

- QuickBooks Enterprise at a glance

- How a Coverdell ESA works

- What is a fuel surcharge?

- Best hosting sites for small business comparison chart

- The mechanics of after-hours trading

- What is CarGurus?

- How to earn Marriott Ambassador Service

- Errors can endanger your credit score

- What is the fastest commercial passenger jet?

- How to earn Delta Choice Benefits

- TAP business class seats and aircraft

- What is the Marriott Bonvoy program?

- 6 steps to starting a wholesale business

- What is a virtual assistant?

- The cost of education in Florida

- 12 best low-cost franchises

- 1. Optimize your website for mobile

- Policies vary by issuer

- What is an S-corp?

- Why would my credit score drop after paying off debt?

- What is a multicurrency account?

- How much is renters insurance in New York?

- What is a sales tax holiday?

- Huntington Bank business checking is best for small-business owners who:

- What are closing costs?

- 5 best gas apps to help you save money

- Claim United miles for past flights on the airline

- Wingstop franchise information

- What are your financial goals for 2020?

- Define your marketing goals

- 1. Find your niche

- What is financial aid?

- Best business cards with no personal guarantee

- 1. Save more

- Minimum wage over time

- What is private mortgage insurance?

- The most popular surveys for cash apps of 2023

- What is a salvage title?

- 40 startup ideas

- Inflation explained

- Can you get car insurance without a car?

- Step 1: Check your credit

- Working with National Debt Relief

- How we chose the best home and auto insurance bundles

- 1. Sell spare electronics

- What are checking and savings accounts used for?

- How buy now, pay later works

- Options for getting a higher credit limit

- What is a virtual assistant?

- Buying an existing business checklist

- What's changing

- Best advice for first-time flyers

- Understanding your solar loan calculator results

- Create a budget plan that works for you

- What is Edmunds?

- Investing through an HSA

- What is permanent life insurance?

- About the passport book

- 1. Account minimum

- Is it OK to invest during uncertainty?

- Why investing is important

- Start with an emergency fund

- 1. Stop adding to debt, if possible

- How much is flood insurance?

- Best business expense trackers at a glance

- United Airlines refund policy

- Comparing the Chase Sapphire Preferred® Card vs. the Chase Sapphire Reserve®

- Individual taxpayer identification number (ITIN)

- What is a credit freeze?

- Best places to sell clothes online

- Costs and fees

- Over limit: The dodo of credit card fees

- Best banks and credit unions

- How do microloans work?

- 7 steps to take to open a savings account

- Average car loan interest rates by credit score

- American Express Cruise Privileges program

- What is franchising?

- How to budget money

- Reasons to buy a second home

- Preparing to buy tips

- Best-performing small-cap ETFs

- How does the Universal Express Pass work?

- How does an estate tax work?

- The best homeowners insurance in New York

- How using stocks as collateral works

- How to fill out Schedule A

- The best time to book rental cars

- Term life vs. whole life: Overview

- What to do when you lose your passport

- Marriott elites become United elites and vice versa

- Free money from the government

- What are estimated tax payments?

- What does this value mean?

- Best ways to invest in real estate

- Ski resorts where Chase cardholders get discounted lift tickets and other perks

- How does a trade-in reduce sales tax?

- Ally Bank CD rates

- What is a personal loan?

- What is zero-based budgeting?

- 1. Open an account at a different bank

- 2022 California state income tax rates and tax brackets

- Best day to book a flight

- What is Instacart?

- Earning

- What does homeowners insurance cover?

- VA streamline refinance

- 1. Less expensive

- Where they’re based and where they fly

- What are the best retirement plans for you?

- How the multiple listing service works

- New York state income tax rates and tax brackets

- What is a co-signer?

- How to start a day care business

- Biggest bond ETFs

- Why you might choose AARP Medicare Advantage

- How FICA taxes work

- 1. You’ll get all the benefits of the The Platinum Card® from American Express

- Is crowdfunded money taxed?

- How pay yourself first budgeting works

- 7 steps to becoming a life coach

- How to detect credit card fraud

- How Treasury bills work

- What does tender mean on a cruise?

- The best car insurance in California

- 14 food franchise opportunities

- Our methodology to find the best personal expense tracker apps

- 1. Have it professionally arranged

- 6 ways to save money on holiday travel

- Where can you rent a safe deposit box?

- Do: Forgive yourself

- 1. Circulate and cross-promote your social media profiles

- 6 steps to managing your 401(k)

- How do bond ladders counter risk?

- Delta’s flight cancellation policy

- Informed Delivery by USPS

- Search online at state agencies

- What is long-term care insurance?

- What is a condo?

- How the mortgage interest deduction works

- The 41 best online business ideas

- Chase checking accounts

- 25 side business ideas to try this year

- Why choose a credit union?

- Does United charge to change flights?

- What are closing costs?

- How to save money while traveling

- Why marijuana stocks are unique and risky

- Fidelity at a glance

- National first-time home buyer programs

- How balance transfers work

- How it works

- Refinance to a lower rate

- How credit card companies work

- 1. The 0% may not apply to everything

- Shopify vs. Etsy: Deciding factors

- How to unfreeze credit

- What is a credit dispute letter?

- ‘An expensive gamble’

- The benefits of gifting stocks

- An overview of Delta Premium Select’s benefits

- 5 basic stock tips for beginner investors

- The key figures used to calculate auto lease payments

- Know your cat's travel options

- Wells Fargo Rewards: The basics

- 1. Choose cars that hold their value

- Savings accounts, national average savings rate: 0.40%

- Is REPAYE right for you?

- When transferring a balance: Yes

- 1. Coupons.com

- Are Life Alert costs covered by Medicare?

- What types of car-buying apps are available?

- 1. Explore alternative locations

- What happens if FedLoan was your servicer?

- Small-business statistics: General facts

- When is a payment marked late on credit reports?

- Request missing AAdvantage miles

- Key findings

- How to remove an authorized user

- Join AAA to avoid underage driver fees with Hertz

- What is an abortion?

- What does a real estate lawyer do?

- What is an underwriter?

- The well-known reasons

- Pet sitting or dog walking

- What you need to know about Delta eCredits

- What is second chance checking?

- Understanding the basics

- How to calculate the cost of starting a business

- Most SBA loans require a personal guarantee

- What types of business insurance do painters need?

- What is a 1099 form used for?

- 1. Hui-chin Chen

- 2. Waived checked bag fees on domestic flights

- 1. Airlines, including Delta, aren’t required to provide compensation for delays

- Car buying’s dirty little secret

- Finding cars sold by private sellers

- You have a grace period

- Most profitable small businesses

- Medicaid eligibility

- Buy: Televisions

- How does a business budget work?

- What to expect flying economy with Korean Air

- December saw a record drop in used-car prices

- 2. Check number

- Forming an LLC in California: Step-by-step instructions

- How teachers can save for retirement

- Is offshore banking illegal?

- What is the Secure 2.0 Act?

- 1. Do your research into Amazon

- What to expect flying first class with Virgin Atlantic

- 1. Understand how the 0% intro APR period works

- Employment outlook

- How to use the mutual fund calculator

- 1. Business name reservation form (corps and LLCs)

- 6 types of investments

- New travel card offers

- When does checking my credit score lower it?

- How state income tax rates work

- Cathay Pacific economy vs. premium economy

- Single-entry vs. double-entry accounting

- Blue Cash rewards compared

- 3 steps for dealing with a debt collector

- 8 Best Hyatt hotels in the Caribbean

- Best free e-commerce website builders at a glance

- 1. Look at the fundamentals of Netflix

- Know your credit

- 1. Your bank account aligns with your goals or values

- 1. Free shipping

- LLC vs. corporation: An overview

- Try a subscription detox

- Cash management accounts

- Booking Emirates first class with partner points

- How much will refinancing save?

- E*TRADE at a glance

- Robinhood at a glance

- Colorado state income tax rates and tax brackets

- Using the debt snowball method

- The best and worst days to fly Memorial Day weekend

- Roth IRA income limits

- Blue Cash Preferred® Card from American Express

- Can you renovate?

- COVID-19 testing, treatments and vaccines

- Delta premium economy seats

- Reserve tickets with your library card

- 1. Fill out the FAFSA

- Pay on time and in full

- History of premarket trading

- Who is a long-term investor?

- Credit score

- Types of business funding

- The pandemic put financial goals on hold for many

- Choice Privileges brands

- 'Buy the dip' meaning

- The pros and cons of Medicare Advantage (Medicare Part C)

- Building a Twitch audience

- States shape how finance is taught

- Obstacles to getting a liquor license

- Benefits of automatic credit card payments

- 1. Ignoring your accounts

- Types of crypto wallets

- Stand your ground and contact your bank

- Should you pay your credit card more than once a month?

- Pursue student loan forgiveness

- Here are six common credit card scams to watch out for

- First, let’s address the elephant in the supply chain

- How much does accounts receivable factoring cost?

- Does an unused credit card affect your credit score?

- What is the California rule?

- The case for buying

- Medicare doesn’t cover most long-term nursing home care

- The main differences between Premium Plus vs. Economy Plus

- The best homeowners insurance in Arizona

- How married filing separately works

- How much does it cost to open a laundromat?

- International roaming plans: postpaid

- Air Canada Aeroplan distance-based award chart

- Protecting yourself from title jumping

- Buy better relationships

- Institutions with low or no overdraft fees

- 1. REITs

- Will savings rates go up?

- What is a bonus?

- Is it worth it to pay points on a mortgage?

- 20 best ways to earn Delta SkyMiles

- 1. Always look at reviews

- Paying won't take a collections account off your credit reports

- How does BNPL for health care work?

- Pie Insurance: Pros and cons

- About the lounges

- No rewards on purchases

- Chase CD rates

- What determines your monthly car payment?

- Financial planner

- How to status match with Delta

- What it means to be an S corporation

- Uber driver requirements

- Here's how much you have to make to file taxes

- Define and refine what you want

- The two cards at a glance

- First, review your cash flow

- What is a credit score?

- You can start building your child’s credit today

- About Lindblad

- No Roth IRA taxes on earnings

- Choose Chase if:

- Does homeowners insurance cover trampolines?

- Original Medicare vs. Medicare Advantage: Overview

- An overview of Marriott elite night credits

- What is group life insurance?

- Read the owners manual

- 1. It’s essentially three products in one

- What does a broker do and why do I need one?

- What is a resort fee?

- How to manage your money

- What is replacement cost insurance?

- You don’t necessarily need to be abroad to be shopping abroad

- You’ll likely be charged fees

- How does Apple Cash work?

- How to downgrade a Chase card

- Acorns at a glance

- How much do online will makers cost?

- Why invest in money market funds?

- Here's how to get a debit card

- Top cards for everyday spending

- How much does adoption cost?

- How to clear your driving record

- Top cards for Uber and Lyft

- What does it mean to live in a state with no income tax?

- Atlanta, Georgia: The Club ATL

- Fed rate increases push up savings rates

- Business loans for the self-employed

- The Hilton cards, compared

- Benefits of balance transfers

- 1. File ASAP

- Average cost of small-business insurance

- 1. What kinds of travel can be booked through the site?

- What is a business credit score?

- United Polaris lounge locations

- GI Bill for coding bootcamp

- How do personal loans work?

- What are United PlusPoints?

- How value-added tax (VAT) works

- 1. Participate in paid market research

- Cheapest days to fly around Thanksgiving

- Why your credit score matters

- How much are VA loan closing costs?

- Which businesses need employer’s liability insurance?

- What is Disney Vacation Club?

- Emergency contraception: Avoiding pregnancy after unprotected sex

- Before you book hotel rooms for families ...

- Pay early

- Step 1: Identify the project and your timeline

- Making it more exclusive (and expensive) to enter

- 1. Explain your situation

- What is a call option?

- Dunkin’ Donuts overview

- Auto insurance

- Key terms in this article

- SEP IRA contribution limits

- Tread depth

- Who qualifies as a tax dependent?

- Quick glance: Index fund vs. mutual fund

- Best e-commerce platforms at a glance

- 30-year mortgage calculator

- Student loan payoff calculator

- High-value Radisson points redemptions

- How mortgage brokers profit from transactions

- 8 steps to open a car detailing business

- Used vs. new

- What you need to know

- TAP Air Portugal partner airlines

- 4 best tips to make money on eBay

- SIMPLE IRA vs. 401(k)

- 1. Contact your issuer

- Buy: TVs

- Top 5 Semiconductor ETFs with NVIDIA

- 1. There are two card options

- 1. Attractive welcome bonus

- How does refinancing work?

- Finding products to sell on Amazon: 6 methods

- What is a bear market?

- Starting a fitness business in 6 steps

- Fees framed as tips

- Report identity theft to the FTC

- Getting to Boston

- What is an authorized user? A joint account holder?

- Are WebBank credit cards good?

- Airline alliances vs. airline partnerships

- Can I get dog bite insurance?

- Why you shouldn’t gift a house

- What happens if you don't comply

- Control what you can

- NerdWallet's airline analysis

- 1. Make your meals instead of ordering takeout

- Figure out your debt load

- How to get business insurance

- What is AirPass?

- What to expect flying premium economy with Delta Air Lines

- Waived baggage fees

- Where to find your credit card’s CVV

- Understanding hedge funds

- How does the Invited program work?

- How does an ESPP work?

- Most business grants are taxable

- Conduct research

- Best stocks by one-year performance

- What is a car insurance declaration page?

- 1. See if cards or digital wallets are accepted

- Best credit cards for food delivery

- SoFi vs. LendingClub at a glance

- What is an insurance broker?

- Banks with no debit card foreign transaction or ATM fees

- 1. Book early before prices go up

- What to know before getting the Capital One Venture X Rewards Credit Card

- How step-up in basis lowers taxes

- Can I get life insurance if I’ve had COVID-19?

- Check your card’s travel protection

- What is ESG anyway?

- What happens when the appraisal is lower than the offer?

- How to calculate RV loan payments

- Biweekly payment calculator

- 1. Low-down-payment mortgages

- Mileage Plan elite upgrades on American Airlines

- CalHFA highlights and eligibility requirements

- How to start a clothing line

- What is an insurance bundle?

- In this review

- What it means to be upside-down

- What qualifies you to be a tax-exempt individual?

- Defining some health insurance terms

- Stock chart components

- Graduate school vs. college

- Is gold a good investment?

- Credit references for potential tenants

- 1. Control spending

- What is cash value life insurance?

- 1. Create a business plan

- Documentation is the difference

- What to consider before loaning money

- Rewards on spending

- What a 695 credit score can get you

- Advice for winter in an RV

- 1. Develop a Plan B

- Bitcoin as an investment

- Best for:

- How a no-closing-cost refinance works

- How does the program work?

- Pros & Cons

- What is an SBA Community Advantage loan?

- How does merchant financing work?

- What is a home inspection?

- Choose Ally if:

- How to start a home business in 9 steps

- When to book an open-jaw itinerary

- Typical loan terms overview

- Business Loan Down Payments 101

- 10 craft business ideas to try in 2021

- What you need to know about starting a hardware store

- How car loans affect credit

- Charles Schwab at a glance

- Used EVs are cheaper than new, but be realistic

- 1. Sign up for Google Fi

- Illinois state income tax rates and tax brackets

- 4 no-gos for picking a car

- Marriott Bonvoy Brilliant® American Express® Card new perks

- Small-business grants for veterans

- Chase checking account and savings account bonuses 2023

- Changes to the Barclaycard Visa with Apple Rewards

- Table of contents

- How much do commercial construction loans cost?

- How to compare FHA vs. conventional loans

- Tax brackets 2022

- 1. Clean up your credit

- 1. Skip the airport

- Biggest life insurers in the U.S.

- State Farm home insurance star rating

- 50/30/20 budget calculator

- How stocks work

- Inflation continues to cool

- How capital gains taxes work

- General advice for international money transfers

- 1. Figure out if you are eligible

- Do I need a passport to cruise to Alaska?

- HELOCs and home equity loans compared

- What happens if I don’t pay my medical bills?

- You booked flexible airline tickets

- What are the three credit bureaus?

- Average monthly expenses by household size

- How trading in a car works

- What is an executive summary?

- 1. Eligibility for the card is based partly on where you live

- 1. You’re afraid to call your financial advisor

- Spending rewards

- Affordable unlimited plans for the average user

- On the day you’re pulled over

- Roth IRA income and contribution limits 2023

- Understanding active and passive investing

- What is a home equity loan?

- Why do people invest in cryptocurrencies?

- American Family renters insurance star rating

- How to buy XRP

- 1. You can use it only on certain health care purchases

- How to transfer money from one bank to another online

- The bull call spread

- The three benefits of dollar-cost averaging

- 2. Leverage brand ambassadors

- Abu Dhabi International Airport

- 1. Brigit: Best for budgeting tools

- Information you’ll need

- Heating and cooling

- 2. Depreciation

- What is IRS Form SS-4?

- Best-performing U.S. equity mutual funds

- The end of cheap airfare?

- Coverage specifics

- How common is credit card fraud?

- Roth IRA income limits

- Who needs to fill out a W-9 form?

- Calculator: Convert United Airlines miles to dollars

- Apps most like Airbnb for cars

- A quick look at the billing cycle

- When do I need a cashier's check?

- Who needs to fill out SBA Form 413?

- How to book Turkish Airlines economy class

- 1. Become an affiliate through Amazon Associates

- What goes into the credit card interest calculation

- Farmers home insurance star rating

- How early direct deposit works

- I want to make more. How do I do that?

- About Geico home insurance

- Certificates of deposit: 4% APY or higher

- When should I buy insurance for my new car?

- Strategies to stay at Disney hotels for less

- 1. Only some purchases are eligible for promotional financing

- Taxes on 401(k) contributions

- How does a Roth IRA work?

- Life insurance risk classes explained

- When should I receive my Form W-2 in 2023?

- Q: What is the Southwest Companion Pass?

- What’s the value when booking travel through the Capital One portal?

- 1. Banks go all-in on customer experience

- What will I need to track my amended tax return status?

- Find student loan refinancing

- A positive attitude can lead to learning and earning

- Competitive market prompts higher down payments

- What to know about AmEx Gold lounge access

- Credit cards and their food-delivery reward rules

- Making a contingent offer on a home

- 15-year mortgage calculator

- Decide what features matter

- Our picks for the best life insurance companies in May 2023

- Options for an old 401(k)

- 5 high-dividend ETFs

- Delta Sky Club at LAX amenities

- How to calculate simple interest in a savings account

- Do rent payments affect credit?

- 2. Haneda Airport

- The self-employment tax rate for 2023

- What does a bookkeeper do?

- Summary: The best places to save money and earn interest

- What you should know about Medicare Supplement Insurance plans

- You have a right to know what’s on your credit reports

- Which cards are affected?

- What is a good FICO score?

- Small-town business ideas

- Top American Express cards that don’t charge annual fees

- Benefits of using a joint account

- Vanguard at a glance

- Rules for refinancing conventional loans

- What does financial compatibility mean?

- What you need to open a bank account

- Available United credit cards

- 1. Do your homework and gather evidence

- Frontier Airlines Discount Den is for you if …

- 1. Request a balance transfer

- Best Medicare Part D plans for 2023

- What are the risks of over-the-phone credit card transactions?

- How to invest in stocks in six steps

- Your personal characteristics

- What is a tech business?

- Southwest Airlines refund policy

- Step 1: Write your business plan

- Who can be a life insurance beneficiary?

- Travel rewards

- Safeco home insurance star rating

- Choose Bank of America if:

- Does paying a phone bill build credit?

- Paying down your debt will take much longer

- Understanding the wash sale rule

- What is tax avoidance?

- What is a conventional loan?

- Best-performing oil ETFs

- Pros of refinancing back to a 30-year loan

- How to estimate your home insurance

- Is an inheritance taxable?

- Custodial Roth IRA rules

- It’s not all about credit scores

- Types of title brands

- What is TSA PreCheck?

- How much does the 2023-24 CSS Profile cost?

- 6 things to do if your rental car is involved in accident

- How to pay rent with your credit card

- The best places to buy a used iPhone

- Does your life insurance have cash value?

- What is a co-op home?

- For the bedroom

- Rolling over your 401(k): The options

- How the Apple savings account works

- 9 popular investment strategies

- 1. You won’t pay fees

- How to get Chase Freedom rental car insurance

- Valuable welcome offer

- At a glance

- A 6-step guide to opening a salon

- In this article

- When curbside check-in isn't worth it

- How to find bankruptcy attorneys to contact

- The best Emirates first class benefits

- What is a dividend aristocrat?

- What is an FHA loan?

- Can you pay student loans with a personal loan?

- What are game apps that pay real money?

- How to qualify for the 24-month grace period

- Types of RVs

- How do down payment assistance programs work?

- The best car insurance in Texas

- Chase joint account

- Why buy dividend stocks?

- How to start a winery: 5 steps to success

- Know how much data you use

- Understanding loan origination

- Multiple applications suggest risk

- What it means to have itemized deductions on your tax return

- An unchanging annual fee

- How the FICO Score 9 is different

- Airline valuation changes

- Before you apply for a card

- What is full coverage insurance?

- Capital One® Walmart Rewards™ Mastercard®

- Steps for filling out the FAFSA for emancipated minors

- Main COVID-era travel industry changes

- When to hold onto credit card statements longer

- What is purchase APR?

- Hotels

- Why you need dog liability insurance

- How much should you save each month?

- What are the potential benefits of pay transparency?

- Best hotel search engine

- Traditional IRA

- Unemployment benefits

- The best hotel chains with two-bedroom suites

- 2. Interest rate

- Ways to finance a business acquisition

- Mortgage rates this week

- Decide when to pay your credit card bill

- Possible reasons for your financial aid suspension

- Set your car payment budget

- Alternative car rental options to consider for your next trip

- Rite Aid

- When to refinance your car loan

- How financial aid is determined

- An effect that’s difficult to quantify

- How a call can help

- Is Christmas Day a good day to fly?

- Key takeaways

- Portfolio management definition

- Where to find a first-time car buyer program

- Key findings

- Who needs a registered agent?

- Make sure your baby is old enough to fly

- When is your recertification deadline?

- How a debt management plan works

- Cash accounts

- What are the advantages of a sole proprietorship?

- What are the stages of foreclosure?

- Interest rate vs. APR

- 1. Get an Individual Taxpayer Identification Number

- Who qualifies for the qualified business income deduction?

- How much does an Amazon Prime membership cost?

- The top 8 businesses by pandemic performance

- Best tips to save money on international flights

- State Farm renters insurance star rating

- Understand your coverage

- How is equity crowdfunding different?

- American Family home insurance star rating

- Nationwide home insurance star rating

- Spirit Airlines bag fees

- How Apple Card Family works

- Unsecured cards that are OK options

- Life insurance calculator

- What is buy now, pay later?

- Pros

- If you've contributed too much to an IRA, fix it before filing taxes

- Americans think they’ll pay only about $2.2K in lifetime fees

- 5 different types of U.S. passports

- 1. Apply for scholarships, fellowships and other grants

- 1. The 2 cards differ in fees, bonus offers and rewards

- How a loan from a credit card works

- When can you retire?

- What is a fee-only financial planner?

- You don't have to start from scratch

- Features

- What is the best streaming service?

- What gets 'imprinted,' exactly?

- How long does it take to close on a home?

- Best-performing clean energy ETFs

- How does a VA loan work?

- The best use of Singapore miles

- 1. ‘I love this car!’

- When to consider a 15-year fixed-rate mortgage

- Inherited IRA rules for spouses

- What is Cash App?

- Finding the money for a deposit

- Cost estimates

- 1. Create a Shopify store

- How does Apple Pay Later work?

- 5 reasons to start a painting business

- Top up your 35K-point Marriott free night certificate with points

- Why you (probably) can't game the system

- Why invest in a real estate ETF?

- Federal tax brackets and tax rates

- 1. A bill due notification

- Farmers renters insurance star rating

- Your credit score could drop if your bank account isn't in good standing

- Liberty Mutual home insurance star rating

- Fraud protection

- Research

- How does an FHA 203(k) loan work?

- The benefits of waiting are huge

- Frugal living food tips

- Why you should acknowledge this voice

- What is Cost Plus Drugs?

- The cost of one-year, two-year and executive MBA programs

- Factors affecting cost

- What is Medicare Part D?

- Improvements increase home value

- Lenders vs. loan servicers

- Does Medicare cover COVID-19 testing?

- Where to get home insurance quotes

- Ways to pay yourself: Salary vs. owner’s draw

- Most popular Medicare Supplement Insurance plan types in Texas

- 1. Buy stocks 'on sale’

- Why the IRS audits people

- 1. Bring a widely accepted credit card

- Calculator: Convert United miles to dollars

- How to choose a business idea

- What is the National Flood Insurance Program?

- What you need to know

- 2. Where are the M Club lounge locations?

- Where to find first-time home buyer credits

- 2. Points never expire

- Hardship loan options

- Pros of refinancing your car loan

- The psychology of credit card spending

- How buy now, pay later works

- SBA franchise loan options

- Average medical school debt

- The best homeowners insurance in Indiana

- What is Opendoor?

- How does Venmo work?

- Xoom is best for:

- Benefits of credit card donations

- Tougher Gold elite status requirements

- Improve your credit

- How much are closing costs?

- 1. Maximize your payments

- How does rental reimbursement work?

- How much interest can you earn on $100?

- You may pay higher rates than others

- Roth 401(k) vs. 401(k): Where they differ

- How to start a consulting business in 9 steps

- 2. Limit your shopping trips

- What responsibilities does an authorized user have?

- Steps for filling out the FAFSA for students requiring a dependency override

- What impact does my bank have on the environment?

- 1. Coddle your credit score

- Home costs depend on age, condition, climate

- What kind of taxes will you have to pay for winning money on a game show?

- Who can get an IP PIN from the IRS?

- How to start a trucking company in 5 steps

- Guide to tipping hotel housekeeping staff

- What are puts and calls?

- What happens if I withdraw from my 401(k) early?

- Current debt consolidation loan interest rates

- How Self — formerly Self Lender — works

- What is Medicare supplement Plan G?

- Where should you start?

- Do I need life insurance?

- What does a certified financial planner do?

- Lower your account balance to $0

- The long call

- You’ll be notified or see a $0 balance

- How to improve your financial health

- How charge cards work

- Best credit cards to use at Apple

- What qualifies for innocent spouse relief?

- What is critical illness insurance?

- Check your account statements

- ANA routes between the U.S. and Japan

- 1. Hit the minimum spending requirement to earn a sign-up bonus

- There's no shame in having money shame

- How long will an accident stay on my record?

- Do you plan to fly with checked bags?

- No fees

- Stock market basics

- Elite status tiers

- What does IHG Ambassador status include?

- The best Marriott resorts in the U.S. for beachgoers

- How AI will likely affect jobs

- Merging finances: plenty of reasons for and against

- Why your credit score is equally important

- Etymology of bullish vs. bearish

- How do LLC taxes work?

- A page from the history books

- Proceed with caution

- What are health care sharing ministries?

- Change and cancellation policies

- The HEA’s debt cancellation history

- When to write a financial aid appeal letter

- How to cancel a Southwest flight

- Top cards for entertainment spending

- 1. Understand asset allocation

- What is a student credit card?

- 2. Ask for an upfront deposit or retainer

- How can ECSI help you?

- Bank of America® Unlimited Cash Rewards credit card: Key details

- What types of travelers benefit the most from loyalty?

- How to find your way around an airport

- Creating an LLC in New York: Eligibility requirements

- How do Frontier’s seat assignment fees work?

- How is the EFC calculated?

- Find out how much your car is worth

- 1. Being unprepared

- How does alternative lending work?

- Option 2: Use your tablet like a phone with a data-only plan

- FAFSA requirements and your eligibility

- Does Florida have a state income tax?

- Benefits of content marketing

- 2. Develop e-commerce sales

- Discover savings bonus

- What is recourse factoring?

- What you'll need to apply for income-driven repayment

- What is a special enrollment period?

- Shopify vs. Squarespace: Deciding factors

- What is hazard insurance?

- 1. You can earn points (at a solid rate) and buy points (at a bad one)

- What is GameFi?

- Amica renters insurance star rating

- Travelers renters insurance star rating

- You need to build credit

- 2 is the magic number

- What dual agency is — and isn't

- When is Prime Day 2023?

- Alternative places to put your money

- Why having cash is important right now

- Should you make a lump-sum student loan payment?

- See if you're right for the job

- How to maintain airline elite status, broken down by program

- Make your mobile device safer

- How it works

- Toast deciding factors

- What is Airbnb?

- 1. Be wary of well-meaning advice

- Plastiq: The basics

- How to earn ANA Mileage Club miles

- What is a seller's disclosure form?

- Small farm business ideas

- What is credit card churning?

- Subsidized vs. unsubsidized student loans

- The scope of the sustainability problem

- Is my child old enough for a savings account?

- 1. For good availability: Mexico City to Madrid (and beyond) on Iberia Airlines

- Why you should get preapproved for an auto loan

- The best homeowners insurance in Virginia

- What are the types of cybersecurity coverage?

- Top USAA credit cards

- Best cash-back apps of 2022

- 1. It can only be used at Maurices

- The main differences between Delta Comfort Plus vs. main cabin

- How does the earned income tax credit work?

- 1. It works only for Michaels purchases

- Pros and cons

- Has EU261 actually reduced delays?

- Step 1: Comply with licensing and zoning laws

- Why new parents need life insurance

- Why tipping is important

- How to avoid paying checked baggage fees

- What is PIP insurance in Florida?

- What is no medical exam life insurance?

- How options work

- The benefits of Star Alliance

- Inflation and rising interest rates affect stocks and bonds

- What counts as transit purchases

- 2. Use the right year’s forms

- What makes a stock a blue chip?

- How does QuickBooks Enterprise work?

- Leverage bonus categories

- 1. Ongoing rewards are lackluster

- How much does Sage 50cloud accounting software cost?

- Deferred/late/skipped payments

- Tips for how to become a day trader

- Points for spending

- Why would an employer look at your credit?

- Best web hosting options for small business

- What would the Congressional Review Act do to student loans?

- Visa vs. Mastercard: Key points

- Best cash-back apps of 2023

- What is lifestyle creep?

- What is an electronic fund transfer?

- Key differences between personal loans and credit cards

- What is the life insurance coverage gap?

- How to start a dog walking business: A step-by-step guide

- CDs are for some savings left untouched

- The difference between the Hyatt Ziva and Zilara brands

- Reasons to decline a car loan

- 'Preapproved' vs. 'pre-qualified' for a credit card

- What Airbnb cleaning fees are and what they cost

- 401(k) contribution limits in 2023

- Fees, fees, fees

- Start with small, manageable charges

- 1. Decide how you want your money managed

- Lyft vehicle requirements

- Why you should join (or not opt out)

- Term life lets you choose your coverage amount

- Airlines with the best flexible travel policies

- What is a stock buyback?

- Citi Flex Loan

- What's the difference between a HELOC and a home equity loan?

- Best credit cards with no credit check

- Pros to investing in CDs

- Is AutoSlash legit?

- 2. Ask your issuer for help

- How much do Instagram influencers make?

- The best money-making apps

- Estimate your car's buyout price

- What’s the purpose of a budget?

- Erie home insurance star rating

- What non-owner car insurance covers

- The best pet insurance companies at a glance

- Communicate with the host first

- 6 Ways to buy Bitcoin

- How much is a Pell Grant?

- How to make money online

- 2. Sell your gift cards

- When to amend a tax return

- What is a low-income loan?

- Income limits for contributing to both an IRA and a 401(k)

- Will student loan forbearance be extended?

- The market outlook for home buyers

- Business information

- 1. You are preapproved with a mail offer

- When can I withdraw money from my Roth IRA without penalty?

- Possible consequences

- What is a crypto loan?

- 1. It offers deferred interest (but not 0%)

- Do you need insurance to rent a car?

- What are the 2023 IRMAA brackets?

- The cheapest car insurance

- Expensify

- 1. Look at the fundamentals of Google stock

- Credit cards with no balance transfer fees

- 1. Child tax credit

- 1. Keep a historical perspective

- The impact of an extension

- Pros and cons of cash management accounts

- How to use the car affordability calculator

- A quick note on how to choose tax software ...

- Oil change prices at chain shops

- Our take

- ETFs vs. mutual funds: The main differences

- How do REITs work?

- Head of household

- Who is getting student loan refund checks?

- 1. Get help with utility bills and groceries

- Capital One Quicksilver Secured Cash Rewards Credit Card: Key details

- How do I find the best 529 plans?

- Pros of online banks

- If you have private insurance

- Why must I discuss this morbid topic?

- When should I use a cashier’s check?

- What do I do with a 1099-INT tax form?

- Builders prefer incentives to lowering prices

- In this article

- 2. Read a book

- Using the debt avalanche strategy

- 1. Affirm

- Traditional IRA contribution rules

- TurboTax's prices

- Why do I need an emergency fund?

- Wells Fargo Active Cash® Card

- State availability

- What are fiduciary duties?

- 2. Skip Park Hopper for multiday trips

- Ways to avoid seat selection fees

- 22 ways to save money

- 1. Qapital

- Table of Contents

- What's the difference between NSF fees and overdraft fees?

- Work with a BFF

- 1. Know your retirement needs

- What are American Airlines Loyalty Points?

- Top United credit card benefits

- How safe are safe deposit boxes?

- 1. Start spending (responsibly)

- What must a debt validation letter include?

- 2. Core inflation is now higher than overall inflation

- Your own insurance usually comes first

- What is liquid net worth?

- The best online life insurance companies of May 2023

- How much are closing costs?

- Blockchain example: Bitcoin

- Saving vs. investing

- The best term life insurance companies in May 2023

- Indoor furniture: Winter, summer

- What is mortgage pre-qualification?

- The best burial insurance in May 2023

- The free miles to dollars calculator

- Where Shopify wins

- What you need to know

- How much does a NC home inspection cost?

- How to earn a return in a Roth IRA

- Pumpkin pet insurance

- Does Medicare Advantage cover medical alert systems?

- Getting help for food insecurity

- You may need your equity later

- 0% intro APR offers don't last forever

- AAA renters insurance star ratings and availability

- 1. You need a Varo bank account to get the Varo credit card

- Peer-to-peer payment apps

- 2. Build your subject matter knowledge

- How many credit cards is too many or too few?

- 9. Long Beach Airport

- Why should you own stocks?

- How to use a HELOC in retirement

- You could qualify within your first year in the home

- Organize your COVID-19 hospital bills

- How it works

- Appraisal bias reports are on the rise

- Common IRS tax forms you should know about (and where to get them)

- AAA auto insurance pros and cons

- Bank of America business checking is best for small-business owners who:

- Black Friday tips to help you save

- Why do you need a goodwill letter and what should you write?

- What you can dispute

- Take out a federal student loan as an independent student

- Ending the ‘continuous enrollment provision’

- 1. Standing could determine the Supreme Court ruling

- Price and reliability aren’t necessarily related

- Getting to Honolulu

- Other low-down-payment loans

- How to invest in bonds: Bonds vs. bond funds

- When to sign up for Medicare before turning 65

- What is offshore banking used for?

- Alternatives to SeedFi’s Borrow & Grow personal loan

- Do your industry research

- Rewards on spending

- How should I invest?

- Medicare’s alphabet soup

- What does a financial coach do?

- Brokered vs. bank CD: 2 big differences

- What are socially conscious actions?

- How Citibank compares to online banks

- Top target-date funds with low costs for 2023

- Inflation has boosted reliance on credit cards

- Types of credit cards

- So what are colleges looking for now?

- The best car insurance companies of May 2023

- International travel takes flight

- Who can bid on an upgrade?

- What to expect flying economy with Cathay Pacific

- No relief from high prices

- The change can be challenging

- Square Online: Best free e-commerce website builder

- What are the types of business insurance?

- Why invest in mutual funds?

- Add your kid as an authorized user

- Hawaiian Airlines refund policy

- Key differences between LLCs and corporations

- How to make money on Upwork

- How much of my credit should I use?

- Bluebird Card Pros

- Beef up your LinkedIn profile

- BEST STORE CARDS

- What is a C corporation?

- Why does tipping matter?

- What is term life insurance?

- PayPal Cashback Mastercard® vs. Apple Card: How they compare at a glance

- What am I willing to sacrifice in terms of space?

- Take advantage of bank or credit union benefits

- Financial planning in 9 steps

- 1. Choose the type of account you want

- State Farm business insurance: Pros and cons

- Go easy on yourself, and start small

- The exceptions

- How hot is the real estate market now?

- Decide how much money to invest where

- Top 5 World of Hyatt hotels on the Strip

- Dependability

- Operating revenue examples

- Easy to get but worth it?

- Long-term investment examples

- Places to cruise without a passport

- More about this card

- States that require insurance

- Top daily losers in the S&P 500

- How to use NerdWallet’s investment return calculator:

- 1. There's more than one version of the store card

- How much does a hard inquiry on your credit report hurt?

- 1. You'll owe fees upon fees