The Loan Estimate and Closing Disclosure: What They Mean

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Of all the mortgage closing documents you’ll encounter during the homebuying process, keep an eye out for two in particular: the Loan Estimate and the Closing Disclosure.

They’re not long and they don’t contain a lot of fine print, but together, these legally required documents boil down all of the closing costs you’ll encounter when getting a home loan.

Reading them carefully can reduce last-minute loan-signing drama. (“Wait, what? That’s a teaser interest rate?”)

What is a Loan Estimate?

The first of these government-mandated documents is just three pages long.

A Loan Estimate details the terms of your loan, including:

Expenses, with clear “yes” or “no” answers to important questions, such as whether each amount can increase after closing, whether your loan includes a prepayment penalty or a balloon payment, and which expenses are included in your escrow account.

The projected monthly mortgage payment, including taxes, insurance and other assessments.

Estimated closing costs and the amount of cash you’ll need to have on hand at the time of settlement.

Information on services you can, and cannot, shop for — such as pest inspections, survey fees and the home appraisal.

Getting ready to buy or refinance a home? We’ll find you a highly rated lender in just a few minutes

Just answer a few questions to get started on a personalized lender match

The Loan Estimate also offers data that can help you compare loan offers from multiple lenders, including total costs of third-party services, the annual percentage rate — your interest rate including fees — and the amount of interest you’ll pay over the loan term, expressed as a percentage of your total loan amount.

The Loan Estimate also offers data that can help you compare loan offers from multiple lenders, including total costs of third-party services, the annual percentage rate — your interest rate including fees — and the amount of interest you’ll pay over the loan term, expressed as a percentage of your total loan amount.

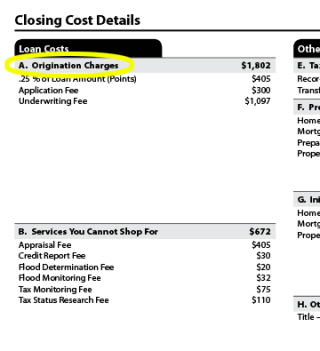

One important section to look for is at the top of Page 2, on the left-hand side of the page. That's where you'll see "Loan Costs" and "A. Origination Charges." You'll find two types of charges here:

Lender fees, which can have a number of different names, including "application fee" or "underwriting fee," as shown; there may be a number of others. These origination fees are negotiable and you'll want to compare them among the lenders you are shopping.

Discount points, prepaid interest that you have the option of paying in order to reduce your interest rate. On the example above, it's shown as ".25% of Loan Amount (Points)."

You’ll receive the Loan Estimate within three days of submitting an application to each potential lender.

» MORE: Calculate your closing costs

What is a Closing Disclosure?

After choosing a lender and running the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that it contains the locked-in costs of your loan and the specific amount you’ll need to pay at closing.

You’ll receive this document three days before your scheduled loan closing. Use this time to review the document for any changes, comparing your Closing Disclosure with the previously received Loan Estimate side by side.

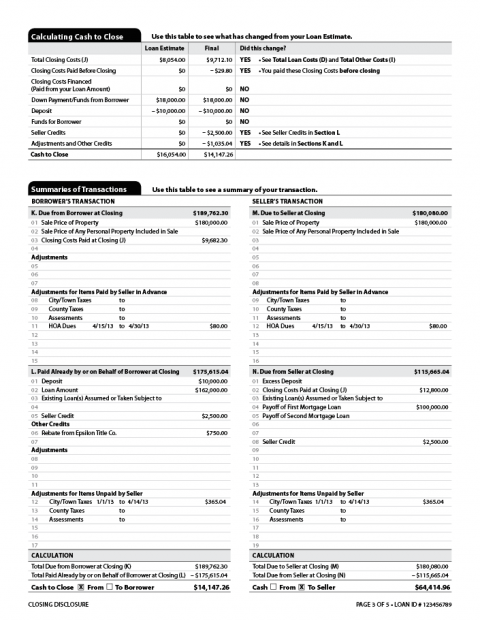

The Closing Disclosure form is just five pages long, but you'll probably spend most of your time reviewing Page 3 — it details the closing costs that you'll pay to the seller. At the top of the page is a comparison table, showing the costs as reported by the Loan Estimate and the actual charges to be applied at closing.

Most important, this section clearly shows whether or not the costs have changed since receiving your Loan Estimate.

At the bottom of the page is the literal "bottom line" — the total amount you, as the borrower, will owe at closing.

What can cause a 3-day closing delay

Any substantial revision to the loan’s terms triggers a new three-day review. However, a change in the amount of a real estate agent’s commission, modifications to the escrow, or adjustments to prorated payments for taxes, utilities and the like don’t qualify. Only three things can reset the 72-hour clock:

The APR increases by more than one-eighth of a percentage point for fixed-rate loans or more than one-quarter of a percentage point for adjustable-rate mortgages.

A prepayment penalty is added to the loan terms.

The loan product changes, such as moving from a fixed-rate to an adjustable-rate loan or to an interest-only mortgage.

Just two closing documents among many

No doubt you’ll see many other documents during the loan closing. Lots and lots of them.

But these two legally binding and required documents bookend the loan process: The Loan Estimate comes after you submit an application with a lender, and the Closing Disclosure form arrives when you’re nearing the get-a-mortgage finish line.

Getting ready to buy or refinance a home? We’ll find you a highly rated lender in just a few minutes

Just answer a few questions to get started on a personalized lender match